Connect Invest

Simplify your investments with Connect Invest, a new kind of investment advisory service that makes it easy to build a smart, tax-efficient, diversified portfolio at a low annual fee of 0.50%. Whether you are investing for retirement or other long-term goals, Connect Invest keeps you on track by monitoring your investments daily, and making sure your money is always working for you by automatically rebalancing your portfolio and reinvesting your dividends.

FEATURES

A personalized investment portfolio that works for you 24/7, including:

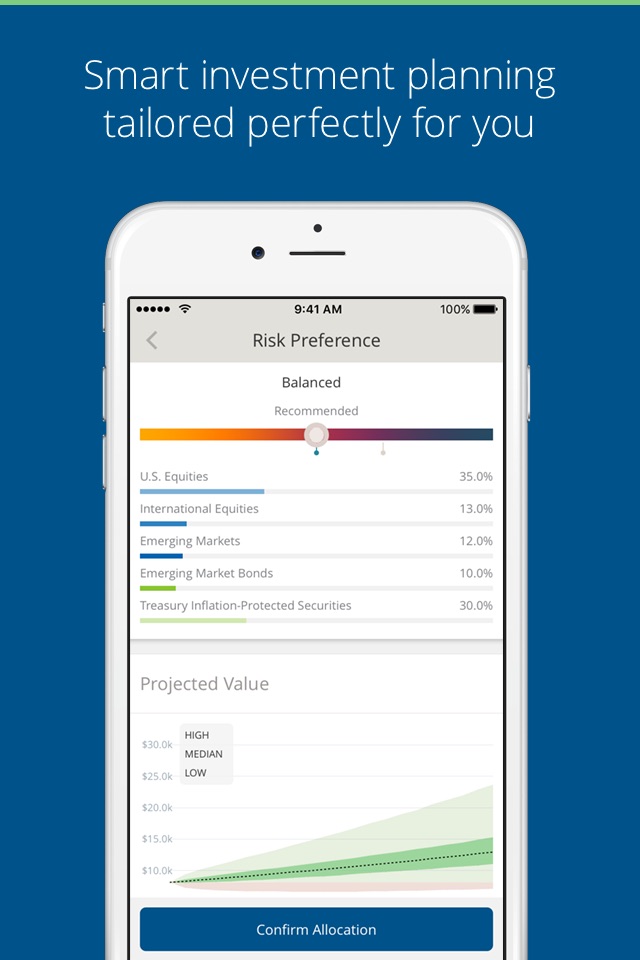

• Personalized portfolio allocation and guidance

Based on your goals and risk preferences, Connect Invest will recommend an investment portfolio tailored to you. Our free, easy-to-use Guidance tool provides in-depth portfolio analysis and recommendations.

• Automated Rebalancing

Whenever your portfolio drifts outside its optimal allocation, Connect Invest automatically rebalances your portfolio.

• Automated Reinvesting

Whenever you receive dividends or deposit cash, Connect Invest automatically reinvests it.

• Cash optimization

Almost all of your cash is always reinvested to avoid the issue of cash drag.

Tax-efficient strategies to minimize your capital gains tax liability and help keep taxes as low as possible:

• Whitelisting

If the holdings you already own are close to what we recommend for you, Connect Invest keeps them in your portfolio.

• Tax-Optimized Sales & Migration

We apply our tax-conscious methodology to minimize taxes when we make a sell in order to maintain your optimal allocation, and when initially converting assets when you transfer your account to Connect Invest.

• Tax Loss Harvesting

We evaluate your portfolio for opportunities offset gains by strategically selling at a loss to help lower your capital gains tax liability - without disrupting your investment plan.

Low fees:

• Pay a low annual fee of just 0.50%. No hidden fees for commissions*, ever. Concierge service through our Investment Advisors:

• Our Investment Advisors are just a call away to help you with guidance, recommendations on your investment strategy, and a personalized plan tailored to your goals.

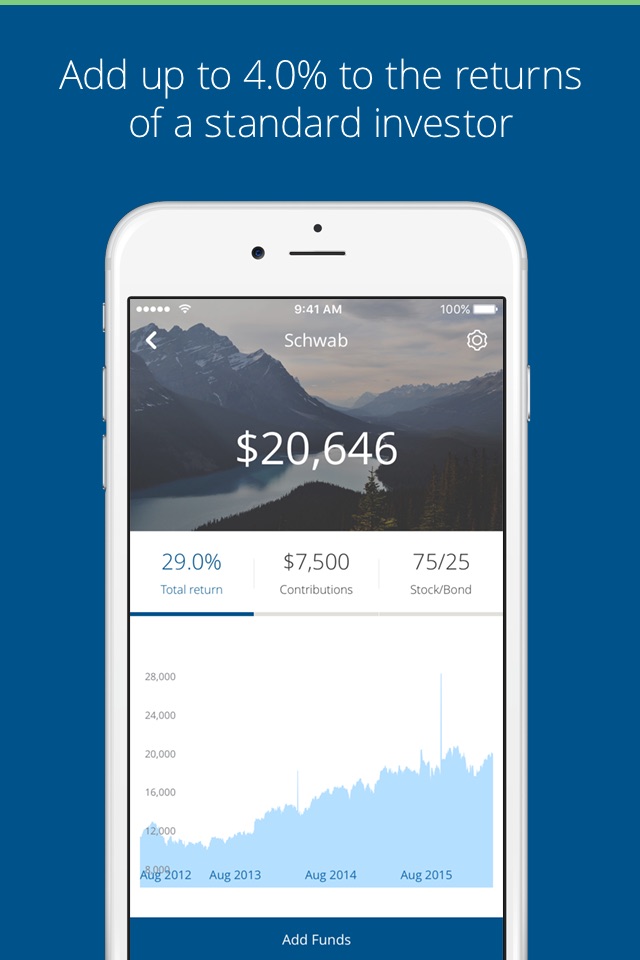

Complete transparency of your investments:

• With summary reports and regular updates, you can always see what’s going on with your Connect Invest accounts and make adjustments along the way, all directly from your CSB online banking dashboard.

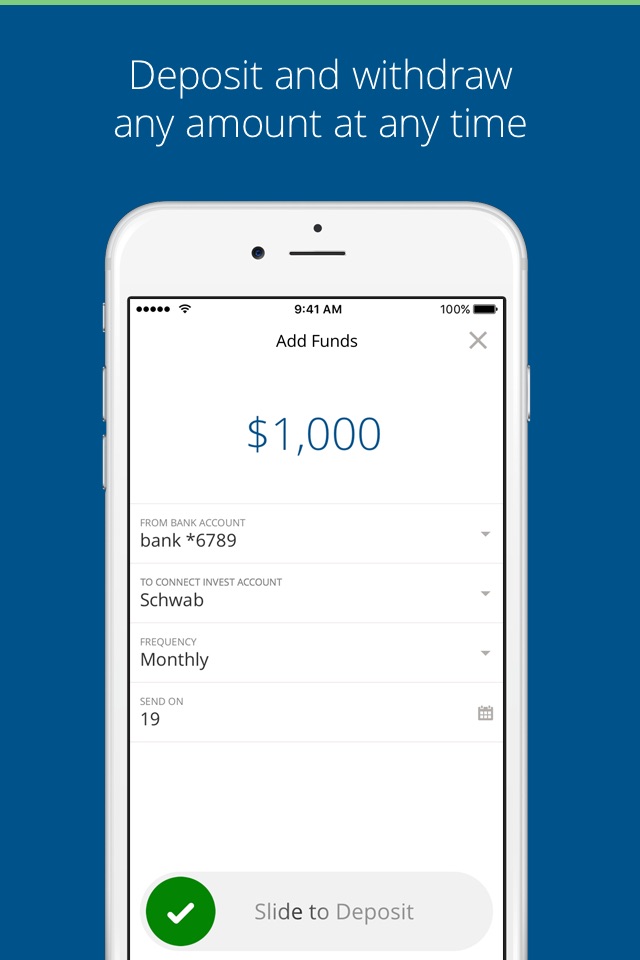

Getting started is easy:

• Simply transfer funds directly from your Cambridge Savings Bank checking or savings account. To get started, you only need $2,000 to invest.

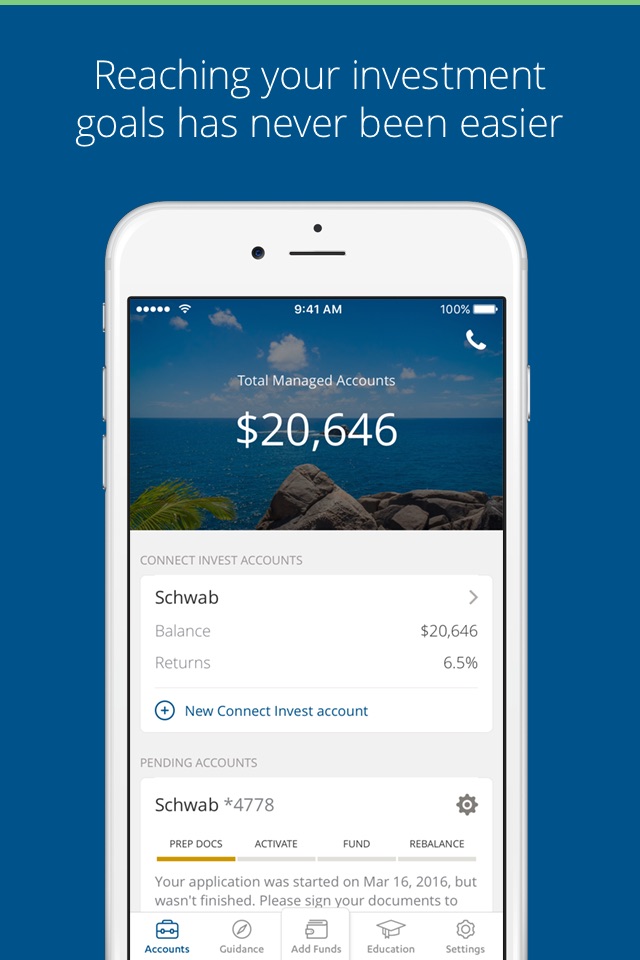

• You can also choose to have your existing brokerage account managed by Connect Invest. If your account is at TD Ameritrade Institutional, Charles Schwab, or Fidelity, your account will stay at the same brokerage and Connect Invest will manage it from there.

*SigFig Wealth Management is not a broker-dealer and does not charge commissions. When Connect Invest clients transfer existing non-cash assets into a Connect Invest account at TD Ameritrade, Fidelity, or Schwab, those broker-dealers may charge the client commissions if SigFig liquidates those assets. SigFig strives to minimize the commissions that broker-dealers charge its clients, and never charges commissions to Connect Invest clients.

Investment products and services are offered independently by SigFig Wealth Management, LLC. SigFig and Cambridge Savings Bank are not affiliated. Products and services made available through SigFig are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of, nor guaranteed or insured by, any bank or bank affiliate. These products are subject to investment risk, including the possible loss of the principal amount invested.